| Arete Insights Q209 |

Welcome

Welcome to the inaugural issue of our mid-quarter edition of Arete Insights! This publication will focus on our commentary and insights regarding the investment management business. Complementing Insights is the The Arete Quarterly report which focuses on the more quantitative information regarding performance and characteristics of the Arete Mid Cap Core strategy. The Arete Quarterly will be published shortly after the end of each quarter.

Having the opportunity to reach out to you is extremely important to us. We very much understand how many investment firms there are and how difficult it is to research, differentiate, and select the right one(s) for you. As a result, we welcome the opportunity to describe how we think about things and to show how we are different from the vast majority of competing investment offerings.

A big part of the rationale for creating Arete was that despite the thousands and thousands of mutual funds, hedge funds, and other investment offerings, there are far too few that provide good value to their investors. Some are awful, some are fraudulent, but most are just mediocre. If mediocre is all you get, you sure shouldn’t pay very much or it is simply not a good value.

This is not to say that there are not a lot of talented people and good organizations in the business. There are, and we have had the privilege to work with many of them. However, the vast and perplexing condition of the investment management business is testament to the many difficulties investors face in trying ensure their financial security.

I have a very simple test to judge investment quality. I ask, as an investment professional, “Would I feel completely comfortable recommending the firm and the product to my friends and family?”

The glaring reality has been that there are desperately few firms and services I could comfortably recommend. As a result, it became increasingly clear to me that there was indeed an opportunity to create an investment firm that met my own high standards for investment quality. From that background emerged Arete Asset Management.

Since I believe very strongly in the value of Arete’s services, I have gone to great lengths to facilitate your evaluation. As a result, transparency is a key feature of Arete’s business model. We try to show you the key features of our product, processes, and people on our website and through the newsletters, and are always available by phone and email. How many of your investment services providers can you say that about? My feeling is that the better you get to know us and what we do, the more impressed you will be.

In short, we are a small business trying to do the right thing. We ask for comments and feedback, because your suggestions help us get better and allow us to progress towards our goal of functional excellence in investment management.

Of course part of the process of building the business is marketing and attracting new clients. As a result, if you know of anyone who may be interested in our services, we would very much appreciate you forwarding our newsletter and passing along our name.

Finally, if you are going to be in downtown Baltimore, please arrange a meeting or stop in and see us. We’d love to get together and talk about what we can do for you.

Thanks and take care!

David Robertson, CFA

CEO, Portfolio Manager

Welcome to the inaugural issue of our mid-quarter edition of Arete Insights! This publication will focus on our commentary and insights regarding the investment management business. Complementing Insights is the The Arete Quarterly report which focuses on the more quantitative information regarding performance and characteristics of the Arete Mid Cap Core strategy. The Arete Quarterly will be published shortly after the end of each quarter.

Having the opportunity to reach out to you is extremely important to us. We very much understand how many investment firms there are and how difficult it is to research, differentiate, and select the right one(s) for you. As a result, we welcome the opportunity to describe how we think about things and to show how we are different from the vast majority of competing investment offerings.

A big part of the rationale for creating Arete was that despite the thousands and thousands of mutual funds, hedge funds, and other investment offerings, there are far too few that provide good value to their investors. Some are awful, some are fraudulent, but most are just mediocre. If mediocre is all you get, you sure shouldn’t pay very much or it is simply not a good value.

This is not to say that there are not a lot of talented people and good organizations in the business. There are, and we have had the privilege to work with many of them. However, the vast and perplexing condition of the investment management business is testament to the many difficulties investors face in trying ensure their financial security.

I have a very simple test to judge investment quality. I ask, as an investment professional, “Would I feel completely comfortable recommending the firm and the product to my friends and family?”

The glaring reality has been that there are desperately few firms and services I could comfortably recommend. As a result, it became increasingly clear to me that there was indeed an opportunity to create an investment firm that met my own high standards for investment quality. From that background emerged Arete Asset Management.

Since I believe very strongly in the value of Arete’s services, I have gone to great lengths to facilitate your evaluation. As a result, transparency is a key feature of Arete’s business model. We try to show you the key features of our product, processes, and people on our website and through the newsletters, and are always available by phone and email. How many of your investment services providers can you say that about? My feeling is that the better you get to know us and what we do, the more impressed you will be.

In short, we are a small business trying to do the right thing. We ask for comments and feedback, because your suggestions help us get better and allow us to progress towards our goal of functional excellence in investment management.

Of course part of the process of building the business is marketing and attracting new clients. As a result, if you know of anyone who may be interested in our services, we would very much appreciate you forwarding our newsletter and passing along our name.

Finally, if you are going to be in downtown Baltimore, please arrange a meeting or stop in and see us. We’d love to get together and talk about what we can do for you.

Thanks and take care!

David Robertson, CFA

CEO, Portfolio Manager

Market Overview

In our January newsletter, we said we thought 2009 would be a “wild ride” and the first four and half months have not disavowed us of that forecast. The good news now, and we do believe it is good news, is that the combination of public policy, fiscal stimulus, and the passage of some time have allowed some semblance of order to form again. Financial Armageddon in the form of deep and sustained deflation has been averted.

We regard the re-establishment of confidence in the financial system as an extremely important achievement. Just months ago, significant concerns regarding the liquidity and solvency of the banking system ran rampant. Nobody believed anything coming out of the banks or the government. There truly was a crisis of confidence. That lack of confidence was exacerbated by dangerously eroding fundamentals and abject fear about how bad things could become.

More recently, many media reports have downplayed the significance and accuracy of the Treasury’s stress tests in particular. First, we find it telling that many investors are complaining the tests were too generous and yet at the same time, many of the banks are complaining the tests were far too harsh. The nearly equal levels of dissatisfaction from both sides suggests to us that the Treasury probably got it about right. Second, it is hard to argue that the banking system is in far better shape now than it was before the tests.

So the good news is that we avoided a head-on collision. The bad news is that we are likely to be on a bumpy road for a while. The consumer still has far too much debt. Too many people have not changed their spending habits, have too much debt to service on a sustainable basis, or both. Things need to change.

That change will most likely involve a combination of reduced consumer spending (in order to work down debt) and economic failure (in the form of bankruptcy) for those who are in too deep or cannot adapt. This will clearly provide a headwind to economic growth and bank credit for an extended period of time.

This prognosis portends a period of transition characterized by cross-currents of financial market activity, public policy, and competitive dynamics. Amid an environment of uncertainty, truly capable management teams and strong business models will increasingly differentiate themselves from weaker ones. “In” will be thinking, adjustment, and adaptation. “Out” will be aggressive risk-taking and business as usual.

The silver lining in all of this is that the premium for good management is higher when times are more difficult. As a result, we view current conditions as being extremely conducive to stock selection. So despite the likelihood of merely moderate economic growth for the immediate future, we are extremely optimistic at the opportunities we see to deliver value through doing the research and picking the stocks that will come out winners.

In our January newsletter, we said we thought 2009 would be a “wild ride” and the first four and half months have not disavowed us of that forecast. The good news now, and we do believe it is good news, is that the combination of public policy, fiscal stimulus, and the passage of some time have allowed some semblance of order to form again. Financial Armageddon in the form of deep and sustained deflation has been averted.

We regard the re-establishment of confidence in the financial system as an extremely important achievement. Just months ago, significant concerns regarding the liquidity and solvency of the banking system ran rampant. Nobody believed anything coming out of the banks or the government. There truly was a crisis of confidence. That lack of confidence was exacerbated by dangerously eroding fundamentals and abject fear about how bad things could become.

More recently, many media reports have downplayed the significance and accuracy of the Treasury’s stress tests in particular. First, we find it telling that many investors are complaining the tests were too generous and yet at the same time, many of the banks are complaining the tests were far too harsh. The nearly equal levels of dissatisfaction from both sides suggests to us that the Treasury probably got it about right. Second, it is hard to argue that the banking system is in far better shape now than it was before the tests.

So the good news is that we avoided a head-on collision. The bad news is that we are likely to be on a bumpy road for a while. The consumer still has far too much debt. Too many people have not changed their spending habits, have too much debt to service on a sustainable basis, or both. Things need to change.

That change will most likely involve a combination of reduced consumer spending (in order to work down debt) and economic failure (in the form of bankruptcy) for those who are in too deep or cannot adapt. This will clearly provide a headwind to economic growth and bank credit for an extended period of time.

This prognosis portends a period of transition characterized by cross-currents of financial market activity, public policy, and competitive dynamics. Amid an environment of uncertainty, truly capable management teams and strong business models will increasingly differentiate themselves from weaker ones. “In” will be thinking, adjustment, and adaptation. “Out” will be aggressive risk-taking and business as usual.

The silver lining in all of this is that the premium for good management is higher when times are more difficult. As a result, we view current conditions as being extremely conducive to stock selection. So despite the likelihood of merely moderate economic growth for the immediate future, we are extremely optimistic at the opportunities we see to deliver value through doing the research and picking the stocks that will come out winners.

Insights

With April showers also comes a flood of proxies so it is an especially timely opportunity to talk about the issue of corporate governance. Most people meet the arrival of proxies with some combination of dread and quiet resignation. Many feel their vote doesn’t matter because they don’t own many shares. Many feel the system is “rigged” and there is nothing they can do.

We don’t dispute that the corporate governance system is seriously flawed and needs to be improved. However, it is not right to think that it cannot be improved. Just looking back over the last ten years or so, we have witnessed important improvements in governance. Most boards are now comprised of a majority of independent board members, far more boards separate the Chairman and CEO positions, and considerably greater scrutiny is placed on stock option grants. It didn’t happen overnight, but corporate governance policies and processes have clearly improved.

To be sure, however, most governance practices still fall well short of what we would consider to be “good”. While we don’t have an absolute standard for measuring quality of governance, we do believe this: As shareholders, we deserve to feel completely confident that our directors are diligent, committed, and acting in our best interest.

One of the issues we feel most strongly about is executive compensation. Put bluntly, the vast majority of executive compensation practices at public companies still range from bad to abysmal. Such policies are grossly over-complicated, butcher the spirit of reasonable goals like “incentives” and “alignment”, and are subjected to little or no real scrutiny.

When we evaluate executive compensation practices, we start with two “common sense” tests. The first test is: Do the policies explain why they are the right policies? The second test is: Does the overall executive compensation package accurately reflect the absolute value created for the company by the named executive? To us, these questions test for “fairness” in the compensation policy. Our concerns were articulately captured by Nobel laureate, James Tobin, when he said, “I [suspect] we are throwing more and more of our resources . . . into activities that generate high private rewards disproportionate to their social productivity.” We just want to see rewards proportionate to productivity.

The whole process of corporate governance reminds us of a social experiment called the “ultimatum game.” The game is set up between two players. Player One gets to chose how to split a pile of coins between the two players. Player Two can either accept the offer, in which case both players get the pre-determined splits, or reject the offer, in which case neither player gets anything.

Originally scientists expected the splits would be extremely disproportionate because any “rational” Player Two would accept a small amount rather than nothing at all. The results were quite different, however. Apparently, people get agitated when they experience such extreme outcome disparities and would rather sacrifice a small personal gain for the sake of not perpetuating inequity. In other words, fairness matters to people.

So what can individual investors do about poor governance practices? For one, investors can certainly vote proxies themselves. Some do, but it does require a certain amount of time and effort to do so effectively and conscientiously. Investors can also hire a manager who researches and seriously considers such issues and votes accordingly. Finally, investors can just passively resign themselves to accepting poor governance as their fate.

While it is true that a small vote may not turn the tides of corporate governance by itself, it is wrong to believe it does not matter. Votes serve as signals to a Board of Directors and those signals can be used to send messages. Even an abstention indicates an active effort to not endorse the Board’s recommendation. Conversely, non-votes also send a message that the investor either completely defers to the Board’s recommendations, or implicitly accepts those recommendations.

It is also important to note that benign neglect may also not be so benign. A longstanding rule allows brokerages to vote shares on behalf of clients when they do not receive instructions from the client ten days before a vote. Not surprisingly, brokerages normally endorse management proposals. Your shares may be endorsing Board recommendations even if you don’t do anything. In fact, this is exactly how two directors of Citigroup recently got re-elected despite widespread dissatisfaction with their service.

With April showers also comes a flood of proxies so it is an especially timely opportunity to talk about the issue of corporate governance. Most people meet the arrival of proxies with some combination of dread and quiet resignation. Many feel their vote doesn’t matter because they don’t own many shares. Many feel the system is “rigged” and there is nothing they can do.

We don’t dispute that the corporate governance system is seriously flawed and needs to be improved. However, it is not right to think that it cannot be improved. Just looking back over the last ten years or so, we have witnessed important improvements in governance. Most boards are now comprised of a majority of independent board members, far more boards separate the Chairman and CEO positions, and considerably greater scrutiny is placed on stock option grants. It didn’t happen overnight, but corporate governance policies and processes have clearly improved.

To be sure, however, most governance practices still fall well short of what we would consider to be “good”. While we don’t have an absolute standard for measuring quality of governance, we do believe this: As shareholders, we deserve to feel completely confident that our directors are diligent, committed, and acting in our best interest.

One of the issues we feel most strongly about is executive compensation. Put bluntly, the vast majority of executive compensation practices at public companies still range from bad to abysmal. Such policies are grossly over-complicated, butcher the spirit of reasonable goals like “incentives” and “alignment”, and are subjected to little or no real scrutiny.

When we evaluate executive compensation practices, we start with two “common sense” tests. The first test is: Do the policies explain why they are the right policies? The second test is: Does the overall executive compensation package accurately reflect the absolute value created for the company by the named executive? To us, these questions test for “fairness” in the compensation policy. Our concerns were articulately captured by Nobel laureate, James Tobin, when he said, “I [suspect] we are throwing more and more of our resources . . . into activities that generate high private rewards disproportionate to their social productivity.” We just want to see rewards proportionate to productivity.

The whole process of corporate governance reminds us of a social experiment called the “ultimatum game.” The game is set up between two players. Player One gets to chose how to split a pile of coins between the two players. Player Two can either accept the offer, in which case both players get the pre-determined splits, or reject the offer, in which case neither player gets anything.

Originally scientists expected the splits would be extremely disproportionate because any “rational” Player Two would accept a small amount rather than nothing at all. The results were quite different, however. Apparently, people get agitated when they experience such extreme outcome disparities and would rather sacrifice a small personal gain for the sake of not perpetuating inequity. In other words, fairness matters to people.

So what can individual investors do about poor governance practices? For one, investors can certainly vote proxies themselves. Some do, but it does require a certain amount of time and effort to do so effectively and conscientiously. Investors can also hire a manager who researches and seriously considers such issues and votes accordingly. Finally, investors can just passively resign themselves to accepting poor governance as their fate.

While it is true that a small vote may not turn the tides of corporate governance by itself, it is wrong to believe it does not matter. Votes serve as signals to a Board of Directors and those signals can be used to send messages. Even an abstention indicates an active effort to not endorse the Board’s recommendation. Conversely, non-votes also send a message that the investor either completely defers to the Board’s recommendations, or implicitly accepts those recommendations.

It is also important to note that benign neglect may also not be so benign. A longstanding rule allows brokerages to vote shares on behalf of clients when they do not receive instructions from the client ten days before a vote. Not surprisingly, brokerages normally endorse management proposals. Your shares may be endorsing Board recommendations even if you don’t do anything. In fact, this is exactly how two directors of Citigroup recently got re-elected despite widespread dissatisfaction with their service.

Insider’s View

As in any business, the more familiar one gets with the underlying structures, relationships, and incentives at work, the more often one can see disparities between the underlying reality of the business and the widespread perception of the business. Our goal in this section is to share our insights into how the investment management business really works. Some aspects of the business simply overwhelm investors with too much information while others can go as far as to work at cross-purposes with investor objectives. In both instances, we hope to provide some clarity.

We discuss these ideas for a couple of reasons. First, we want to share our knowledge and experience in the business in order to help people better-achieve their investment goals. Second, we do this partly to help differentiate the value of our services. We believe the more we can help you understand the underlying reality of the investment management business, the better you will be able to make the best decisions for yourself and the more you will appreciate what we do and why we do it.

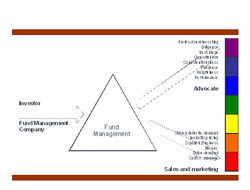

The “Insider View” topic we chose to begin with is the dichotomy between how investment management business views the business of investment management and how investors themselves view the business. This dichotomy is illustrated in the diagram below as opposite ends of a spectrum. While this depiction applies to much of the business, for simplicity we will focus on its application to mutual funds.

When most investors buy shares in a mutual fund, for example, they expect to receive a number of benefits in exchange for the management fees they pay. At very least, investors expect to benefit from the knowledge and expertise of a well-trained research staff. It is also reasonable to expect that since a mutual fund aggregates assets from many investors, the operating costs per investor should be lower than for any investor individually. Finally, investors rightly expect the fund manager to act as a fiduciary who always puts the interests of its investors first.

The reality of the investment business is that far too often, the fund management company gets seduced by the opportunity for profit and in the process, subordinates many of the wants and needs of its customers to its own business goals.

To understand how this can happen, let’s look at the business from the perspective of a fund management company (FMC). When the FMC looks at the investment business, it sees a terrific business model. The nature of the business is such that once fixed costs get covered, there is an opportunity to generate incredibly high incremental returns. As a result, the top economic priority of the FMC is to drive revenue growth. While investment returns can help drive revenue growth, it takes time. It is far easier and faster to generate growth through new fund inflows.

Fortunately (for the FMC), the business plan to execute revenue growth is very simple. Step one: Fill every distribution channel possible and flood all of the shelves with lots of different products. Make sure that customers can get whatever product they want wherever they may want to buy it. Advertise like crazy. Step two: Retain clients. Since most investors are reluctant to leave unless performance is really bad, this usually means staying close to a benchmark or “closet indexing”.

You may have noticed that the business prerogatives for the FMC don’t seem very highly correlated with investors’ wants, needs, and expectations. You would be right. In fact, the drive for revenue growth is often directly at odds with the best interest of investors. This conflict is probably most clearly displayed by industry pricing practices.

There is no doubt that any fees charged to investors both reduce principle amount and the power of those returns to compound over time. Despite substantial cost reductions in transaction fees, computing equipment, and telecommunications, and despite the increasing scale of the mutual fund business (and the greater capacity of that scale to absorb costs), and despite the detrimental effects of high fees on investment performance, mutual fund fees for investors remain persistently high.

Interestingly, the issue of mutual fund fees is finally getting some real attention — from the U.S. Supreme Court. Pensions and Investments recently reported that a case currently under review, Jones vs. Harris Associates, LP, “alleges Harris violated its fiduciary duty under the Investment Company Act by charging investors in the firm’s Oakmark mutual funds more than double what it charges pension funds and other independent institutional investors for managing similar strategies in separate accounts.” How would you feel if you learned your manager did the same thing?

We do live in a free country, however, and we are fortunate to have well-functioning capital markets. As a result, the “right” price of any good or service is the price the market bears. If investor’s think the price is too high, they can always vote with their feet by walking away and finding a cheaper alternative. To the extent investors buy mutual funds with high fees, it is hard to conclude that those funds are not good, highly competitive products.

As in any business, the more familiar one gets with the underlying structures, relationships, and incentives at work, the more often one can see disparities between the underlying reality of the business and the widespread perception of the business. Our goal in this section is to share our insights into how the investment management business really works. Some aspects of the business simply overwhelm investors with too much information while others can go as far as to work at cross-purposes with investor objectives. In both instances, we hope to provide some clarity.

We discuss these ideas for a couple of reasons. First, we want to share our knowledge and experience in the business in order to help people better-achieve their investment goals. Second, we do this partly to help differentiate the value of our services. We believe the more we can help you understand the underlying reality of the investment management business, the better you will be able to make the best decisions for yourself and the more you will appreciate what we do and why we do it.

The “Insider View” topic we chose to begin with is the dichotomy between how investment management business views the business of investment management and how investors themselves view the business. This dichotomy is illustrated in the diagram below as opposite ends of a spectrum. While this depiction applies to much of the business, for simplicity we will focus on its application to mutual funds.

When most investors buy shares in a mutual fund, for example, they expect to receive a number of benefits in exchange for the management fees they pay. At very least, investors expect to benefit from the knowledge and expertise of a well-trained research staff. It is also reasonable to expect that since a mutual fund aggregates assets from many investors, the operating costs per investor should be lower than for any investor individually. Finally, investors rightly expect the fund manager to act as a fiduciary who always puts the interests of its investors first.

The reality of the investment business is that far too often, the fund management company gets seduced by the opportunity for profit and in the process, subordinates many of the wants and needs of its customers to its own business goals.

To understand how this can happen, let’s look at the business from the perspective of a fund management company (FMC). When the FMC looks at the investment business, it sees a terrific business model. The nature of the business is such that once fixed costs get covered, there is an opportunity to generate incredibly high incremental returns. As a result, the top economic priority of the FMC is to drive revenue growth. While investment returns can help drive revenue growth, it takes time. It is far easier and faster to generate growth through new fund inflows.

Fortunately (for the FMC), the business plan to execute revenue growth is very simple. Step one: Fill every distribution channel possible and flood all of the shelves with lots of different products. Make sure that customers can get whatever product they want wherever they may want to buy it. Advertise like crazy. Step two: Retain clients. Since most investors are reluctant to leave unless performance is really bad, this usually means staying close to a benchmark or “closet indexing”.

You may have noticed that the business prerogatives for the FMC don’t seem very highly correlated with investors’ wants, needs, and expectations. You would be right. In fact, the drive for revenue growth is often directly at odds with the best interest of investors. This conflict is probably most clearly displayed by industry pricing practices.

There is no doubt that any fees charged to investors both reduce principle amount and the power of those returns to compound over time. Despite substantial cost reductions in transaction fees, computing equipment, and telecommunications, and despite the increasing scale of the mutual fund business (and the greater capacity of that scale to absorb costs), and despite the detrimental effects of high fees on investment performance, mutual fund fees for investors remain persistently high.

Interestingly, the issue of mutual fund fees is finally getting some real attention — from the U.S. Supreme Court. Pensions and Investments recently reported that a case currently under review, Jones vs. Harris Associates, LP, “alleges Harris violated its fiduciary duty under the Investment Company Act by charging investors in the firm’s Oakmark mutual funds more than double what it charges pension funds and other independent institutional investors for managing similar strategies in separate accounts.” How would you feel if you learned your manager did the same thing?

We do live in a free country, however, and we are fortunate to have well-functioning capital markets. As a result, the “right” price of any good or service is the price the market bears. If investor’s think the price is too high, they can always vote with their feet by walking away and finding a cheaper alternative. To the extent investors buy mutual funds with high fees, it is hard to conclude that those funds are not good, highly competitive products.

RSS Feed

RSS Feed