July 2024

Stocks continued to run in the second quarter with the S&P 500 posting a total return of 4.28% for the second quarter and 15.29% for the first half. After a bit of weakness early in the quarter, it took only a few weeks for stocks to resume their winning ways. Once again, big tech, artificial intelligence, and momentum were leading themes.

Another leading theme was the Fed "put", the practice of monetary authorities easing financial conditions when markets become turbulent, or even just stagnant. As concerns about growth have been increasing, so too have expectations of market-friendly rate cuts from the Fed also been increasing. The result is, there is almost never an environment that is bad for stocks.

Or so the thinking goes. The hard fact of the matter is that the environment in which the Fed operates has changed in many ways – and in ways that increasingly impose constraints. The bottom line is the inordinate degree of faith investors place in the Fed to ensure favorable market outcomes is becoming increasingly misplaced.

Long live the Fed put

To be sure, there are valid reasons for believing in the Fed's support of the market. For starters, there is history. Since the late 1990s, and arguably going back even further, the Fed has made a practice of easing financial conditions whenever turbulence arose. Financial stability has been a priority, and it remains a priority.

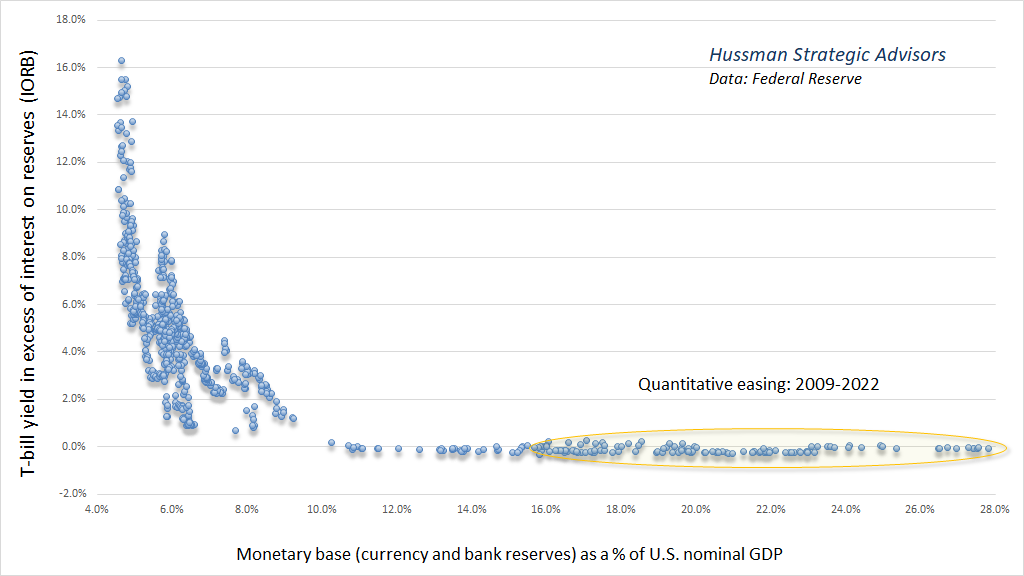

In addition, the Fed has a more expansive toolkit today than it ever has to deal with a wide variety of financial miscues. The GFC featured Quantitative Easing (QE) which was amped up during the Covid lockdowns. The Fed also made the Standing Repo Facility (SRF) permanent, added the Bank Term Funding Program (BTFP) during the banking crisis in early 2023, and has been working to improve the effectiveness of the Discount Window. All of these serve as important backstops for financial plumbing as well as safety nets for financial markets.

Finally, the Fed also recently decided to substantially scale back its Quantitative Tightening (QT) program. After committing to reduce its obscenely bloated balance sheet (from QE) and return to some kind of monetary normalcy, it lost its heart for discipline and caved in. As a result, it is easy to assume the Fed is already on a trajectory of easing again. Rate cuts are just the next logical step.

What has made the Fed put especially potent, however, is the belief system that the Fed not only CAN operate to protect financial markets, but also that it WILL always succeed in boosting them. Some time after the GFC, the Fed put morphed from being a safety net against disruptive dislocations into a guarantee of strong returns. As a result, investors have become habituated to increasingly aggressive intervention. This creates a self-fulfilling prophecy that works as long as investors believe it works. We'll come back to this.

A different point of view

Although the Fed still exhibits a tendency of pandering to markets, it doesn't take much imagination to also see how its hand has gotten much weaker.

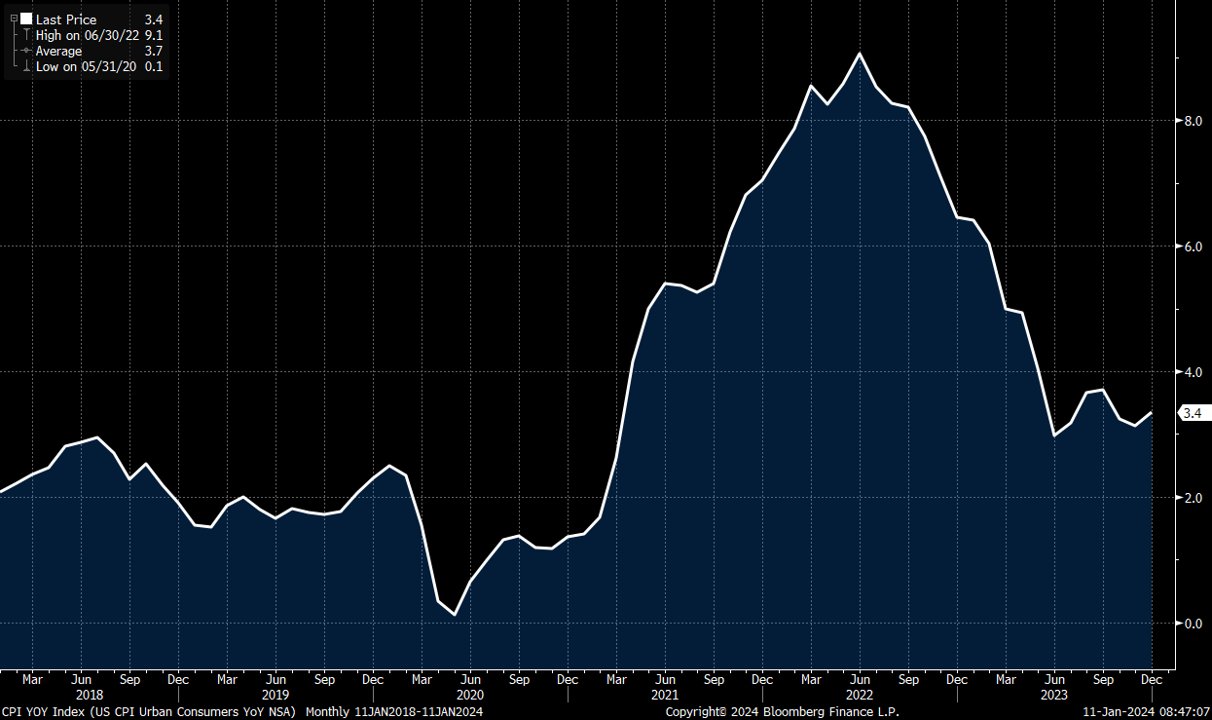

For example, when inflation rose noticeably higher in 2021, the Fed responded by raising rates in 2022. Not only did it raise rates, but it raised them to over five percent. And it has held them at over five percent for over a year. At the same time, it was also reducing its balance sheet through Quantitative Tightening (QT).

While there were clearly valid reasons for the Fed to tighten policy at the time, its actions were on the tight side. Interestingly, at the same time, its words were often on the dovish side.

Indeed, to the extent actions have induced easier financial conditions, those actions have come from the Treasury, not the Fed. While the two have been working in concert since Covid, it is not a trivial distinction that most of the liquidity provision has come from Treasury in the form of disproportionately high issuance of Treasury bills. Conversely, when the Fed did provide liquidity to banks in early 2023, the provision was limited in both scope and duration.

One view has it that the new direction in Fed policy is simply a temporary adjustment that has been necessary until conditions return to "normal". Upon closer inspection, however, it can also be seen that conditions across several dimensions have changed in ways that impinge upon the Fed put.

Changing conditions

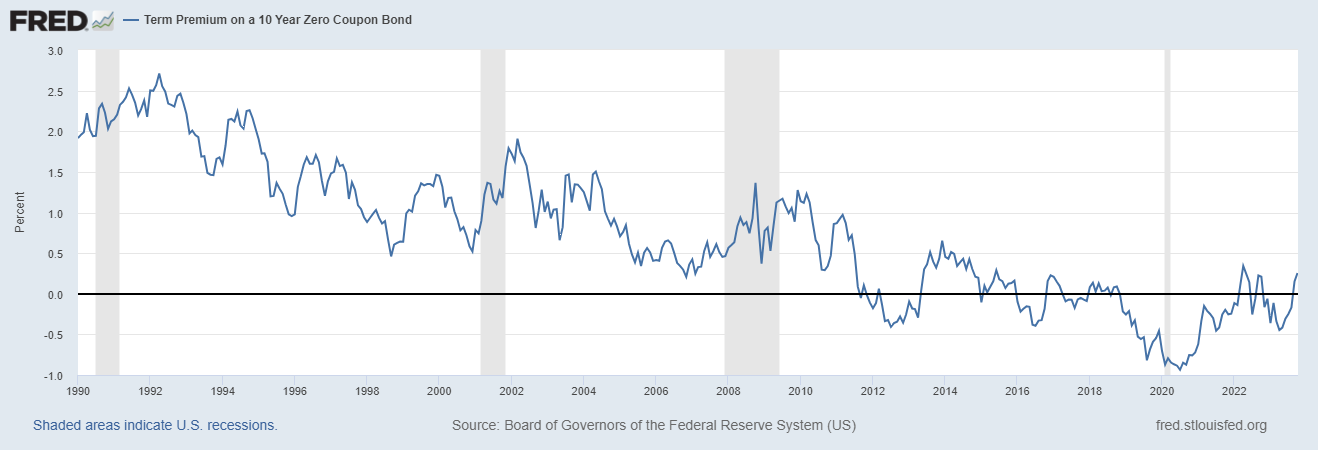

One of the most damaging changes is the increasing realization that the key policy of Quantitative Easing (QE) often creates more trouble than it's worth. ECB executive director, Isabel Schnabel, recently noted that "QE exposes central banks to considerable interest rate risk", that "losses [on government bonds] ... impede central banks’ ability to pursue their price stability mandate", and that "Surging asset prices do not only pose risks to financial stability but may also exacerbate wealth inequality" (h/t Russell Napier in his Solid Ground newsletter).

She concludes, "The experience over the past 15 years suggests ... that QE can come with costs that might be higher than those of other policy instruments..."

This was not an isolated, one-off comment either. Rather, it reflects new consensus thinking in central banking circles. In summarizing the annual report from the Bank of International Settlements (BIS) for example, the FT ($) noted, "there are limits to prolonged monetary easing with diminishing returns and unwelcome side-effects". In short, central banks tried QE in a pinch, kept at it for fifteen years, and discovered it had toxic side-effects. Now, in order to mitigate political backlash, it is only retained for acute, and not chronic, conditions.

Of course, this also highlights important ways in which the political environment has changed. After several decades during which capital was favored over labor, Covid lockdowns highlighted both the importance of “essential” blue collar jobs and the meager wage growth associated with those jobs. Covid proved a timely impetus for the political pendulum to start swinging back to wage earners.

This shift in political priorities is problematic for the Fed in two ways. First, the "exacerbation of wealth inequality" caused by its policies puts it squarely in the cross-hairs of populist politics. Second, increasing political momentum behind wage increases for workers will make it increasingly difficult to keep inflation under control. Neither of these were big problems or concerns when the Fed put started.

Finally, the changing character of geopolitics is also impinging on Fed policy. While the Fed had been able to implement its put in previous episodes with virtually no concern for ramifications outside the US, China's emergence as a competitive superpower and Russia's invasion of Ukraine in 2022 fundamentally changed the landscape. Within this new context of superpower rivalry, unrestrained growth in federal debt is no longer an innocent happenstance, but rather a glaring geopolitical vulnerability.

Soaring public debt is not the only weakness. The Fed's policy of maintaining excessively low interest rates for an extensive period of time did more than just create an incentive to consume too much debt; it also reduced the financial incentive for industrial companies to reinvest in their businesses. As a result, America’s industrial capacity got hollowed out and its supply chains became much more vulnerable to geopolitical shocks. In short, the ramifications of the Fed put regime now very visibly conflict with the objectives of national security.

Implications

These examples highlight just how much conditions have changed since the Fed first implemented its "put". As a result, the Fed is now much more constrained in effecting monetary policy and therefore much more constrained in effecting positive market outcomes. While the Fed would surely intervene in the event markets stopped functioning smoothly, the scope of its "put" is almost certainly far more conditional and far less expansive than it has been in the past. Effectively, the Fed's “put” is kaput.

Today, the diminishing viability of the Fed put as policy contrasts sharply with the faith investors have in it to guard their investments. Indeed, investors still clamor for any little inkling of when the Fed may cut rates or otherwise ease financial conditions.

Certainly some investors have become habituated to the Fed put and don't really give it much thought any more. Other investors remain steadfast in their belief in the Fed's ability to drive markets. Still others though, are increasingly aware of the constraints on the Fed and its ability to drive positive market outcomes.

What holds everything together is that the Fed put is still common knowledge. Everyone knows that everyone believes the Fed put is still in place. This creates a self-fulfilling prophecy: As long as the belief system remains in place, the belief is the reality.

The problem with this dynamic is that it can be quite fragile; it can change very quickly. As Ben Hunt wrote about President Biden after the presidential debate, "That’s the moment where we all saw what we all saw, that Joe Biden is not mentally competent to be president of the United States." He goes on, "This is about the moment in time that irrevocably changed what we all know that we all know about Joe Biden."

Now, let's apply the same common knowledge framework to the Fed. Imagine a situation, not too far into the future, in which economic, political, and geopolitical forces continue limiting the Fed’s room for maneuver. Maybe it’s a combination of persistently high inflation and weak economic growth. Maybe it’s a geopolitical event. It could be a lot of things.

At some point, regardless of what the Fed does, or doesn’t do, markets will be worse off. When that happens, everybody will know that everybody knows the Fed is severely constrained and can no longer dictate positive market outcomes.

Worse, as Hunt describes, as long as "everyone in the world believes a certain piece of private information, no one will alter their behavior. Behavior changes ONLY when we believe that everyone else believes the information. THAT’S what changes behavior." So, when everybody knows that everybody knows that the Fed no longer has the power to make the market keep going up, behavior will change. At that point, an important obstacle to shorting the market will be eliminated.

Conclusion

In summary, for many years investors have bestowed upon the Fed near-magical powers to drive markets higher. This belief system created a self-fulfilling prophecy that made it extremely difficult for investors to bet against.

Over time, however, conditions have changed and now the costs of the Fed put have increased while its benefits have decreased. As a result, the day is approaching when the Fed will no longer be able to ensure positive market outcomes. This will mark the threshold of a new era of monetary policy and of market behavior.

When that day comes, investors will no longer be able to rely on the Fed as their guardian angel; doing so will be futile. They will no longer be able to ignore risk. They will need to be able to weather turbulence and be able to withstand significant and persistent drawdowns. They will need to do analytical work.

As the high waters of monetary largesse recede, it will become clear that a lot of investors have been swimming naked.

RSS Feed

RSS Feed