October 2016

Markets recovered quickly from the turmoil from the Brexit vote at the end of the second quarter and rode out the summer with exceptionally low levels of volatility. While this oft-repeated pattern has frustrated the efforts of many long term investors waiting for better opportunities, one silver lining is that it has also created an environment of low opportunity cost for investors to investigate longer term investment drivers.

One of those longer term investment drivers is economic productivity. Despite its stature as one of the most important economic metrics, the subject of productivity rarely makes the headlines or inspires public discussion. Partly as a result of this absence, many investors have formed somewhat vague, yet fairly confident, narratives around the idea that productivity is improving nicely due to technology. This is a nice story but one that is incomplete at best, and misleading at worst.

Interestingly, the importance of productivity as a measure of well-being is one of the few areas of consensus in economics; it's just not controversial. As the Bureau of Labor Statistics (BLS) states [here], "Only if we increase our efficiency—by producing more goods and services without increasing the number of hours we work—can we be sure to increase our standard of living."

There is also fairly wide consensus that productivity growth has been weakening. As the BLS reports, "Productivity growth in recent years hasn’t been as strong, however. It may seem surprising, given all the new technologies and products in recent years, but we are now living through one of the lowest productivity-growth periods ever recorded. Since the Great Recession of 2007–09 began in the fourth quarter of 2007, labor productivity has grown just 1.0 percent per year. That is less than half the long-term average rate of 2.2 percent since 1947."

And this isn't a phenomenon that popped up out of nowhere. The BLS goes on to highlight exactly how pronounced and sustained the downturn in productivity has been: "Labor productivity growth in the nonfarm business sector is lower in the current business cycle than during any of the previous ten business cycles." In other words, despite many investors feeling reasonably optimistic about the economy, the reality is that productivity growth has been eroding for a long time. If trends continue there is a very real chance that future living standards may not rise and could even decline.

There is a compelling body of evidence that identifies various causes of declining productivity growth. The OECD report "The Productivity-Inclusiveness Nexus" [here] noted that, "the types of innovations that took place in the first half of the 20th century (e.g. electrification etc.) are far more significant than anything that has taken place since then (e.g. ICT [information and communications technology]), or indeed, likely to transpire in the future (Gordon, 2012; Cowen, 2011)."

The report also elaborated that, "These arguments are bolstered by evidence of the slowdown in business dynamism observed in frontier economies such as the United States. Gordon (2012) also argues that there are a number of strong headwinds on the horizon that will cause productivity growth in the US to slow further, including ageing populations, a deterioration of education, growing inequality, globalisation, sustainability, and the overhang of consumer and government debt."

While these forces create powerful headwinds for productivity growth, there are also important forces promoting greater productivity. The same OECD report specifically acknowledged the case for optimism. The report notes, "That the underlying rate of technological progress has not slowed and that the IT revolution will continue to dramatically transform frontier economies."

The report went on to note, "According to Brynjolfsson and McAfee (2011), the increasing digitalisation of economic activities has unleashed four main innovative trends: i) improved real-time measurement of business activities; ii) faster and cheaper business experimentation; iii) more widespread and easier sharing of ideas; and iv) the ability to replicate innovations with greater speed and fidelity (scaling-up). While each of these trends is important in isolation, their impacts are amplified when applied in unison."

In addition, it is also important to note that the negative trend in productivity growth may appear worse than it really is due to measurement problems. There is no doubt that as new technologies, big data, and platform business models have become ever larger parts of the economy that conventional measures of physical output may not perfectly capture these changes. While it makes sense to keep this caveat in mind, it does not support a case for completely ignoring the troublingly negative trends in productivity.

The presence of both positive and negative influences on productivity is also clouded by the presence of both shorter-term, cyclical and longer-term, secular forces. According to the OECD [here], the great concern is that, "Against a backdrop of increases in income and wealth inequalities ... this may reflect a structural, and not a cyclical, slowdown." Indeed, the prospect of a "structural slowdown in productivity" ought to send the risk antennae of long term investors quivering.

In order to disentangle these issues, The Economist provided a useful overview [here]: "The most important determinants of longer-term productivity growth are the rate of adoption of existing and new technologies, the pace of domestic scientific innovation and changes in the organisation of production."

The OECD's Productivity-Inclusiveness report also noted that, "One possible explanation suggests that the main source of the productivity slowdown is not the slowing of the rate of innovation by the most globally advanced firms, but rather a slowing of the pace at which innovations spread throughout the economy: a breakdown of the diffusion machine (Andrews, Criscuolo and Gal, 2015)"

Indeed, the "rate of adoption of existing and new technologies" was the featured topic in the OECD Productivity-Inclusiveness report. The report stated, "Many firms have also failed to successfully adopt new technologies and best practices. The main obstacle to stronger productivity growth has not been the unavailability of advanced technology, but rather the lack of successful adoption by many firms."

At a concrete level it is all too easy to see various manifestations of firms that "have failed to successfully adopt new technologies and best practices." On one hand, a person can wait for four hours to set up an internet connection, wait two and a half weeks to get an eye exam, and wait forever to have a roofing contractor call back. On the other hand, a person can also order food and watch the delivery person's progress on his or her smart phone and meet them at the door. Two different worlds in terms of technology adoption.

As the Economist noted [here], the successful adoption of "new technologies and best practices" involves a lot more than just products. It also includes processes and culture as well: "An economy's potential output depends on the amount of labour and capital available, and on the ingenuity with which those resources are put to use. Of these three factors ingenuity is by far the most important. It accounted for about 88% of the growth in output per man-hour between 1909 and 1949, according to a 1957 paper by Robert Solow which helped bag him a Nobel prize. Mr Solow labelled this all-important factor "technical change", a catch-all term for anything that "yields more output from the same inputs of labour and capital. It could include break through inventions, like the internal combustion engine, or organisational improvements, like the assembly line or the traffic roundabout."

Unfortunately, some important obstacles are impeding the forces of "technical change" as illustrated in a recent article in The Atlantic [here]. The article notes, "Americans today are strangely averse to change. They are less likely to switch jobs, or move between states, or create new companies than they were 30 years ago." Notably, it highlights that "the phenomenon stems from a significant root cause: the cost of having a place to live in America’s most productive cities." This problem is not isolated either: "mobility rates have fallen across every level of education and marital status, and they’ve actually dropped the most for young workers." The article concludes that, "People aren’t moving toward productivity. They’re moving toward cheap housing." The net effect is a decline in geographic mobility that restrains productivity growth.

This is where things are now, but they don't have to stay this way. Clearly there is room for constructive public policy. The OECD, in particular, calls for "policy makers to adopt a broader, more inclusive, approach to productivity growth that considers how to expand the productive assets of an economy by investing in the skills of its people and providing an environment where all firms have a fair chance to succeed, including in lagging regions." In another report [here], the OECD recommends "Synergic investments in R&D, skills, organisational know-how (i.e. managerial quality) and other forms of knowledge-based capital to enable economies to absorb, adapt and reap the full benefits of new technologies." Regardless of the outcome of policy initiatives, however, these are still useful landmarks by which investors can measure the progress of technology diffusion.

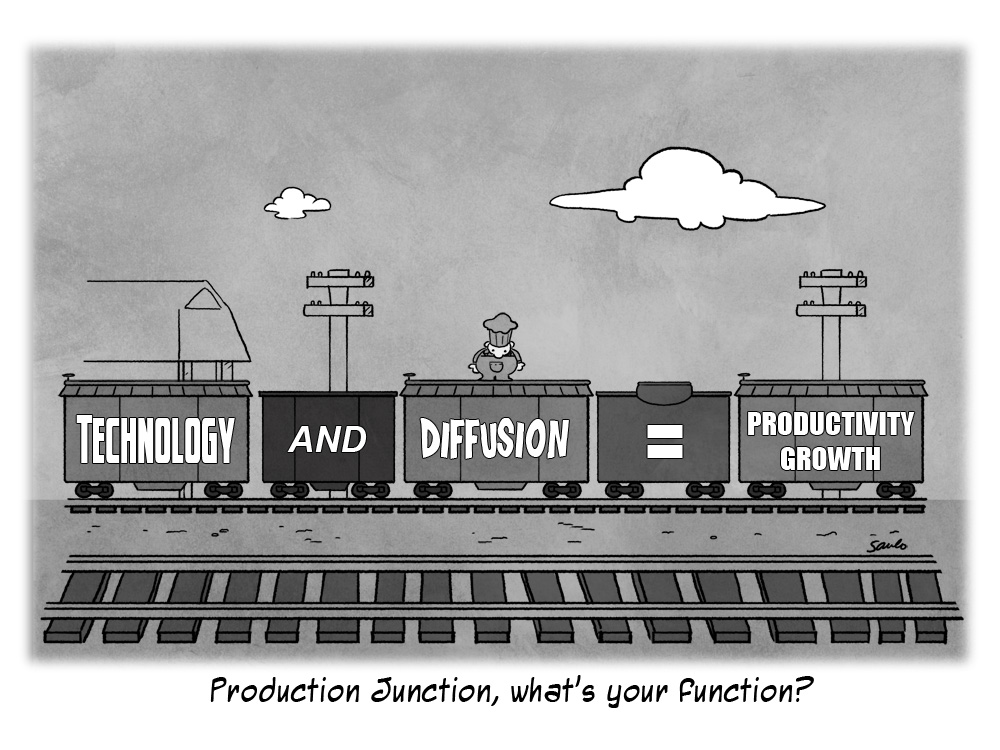

One of the great strengths of the US economy is its capacity to nurture technological development and innovation that manifests itself in increasing productivity and ultimately higher living standards. While the "engine" of technology has continued to run fairly well, the preponderance of evidence points to low and declining productivity. This does not bode well for economic growth, or by association, for equity investments. Under-reporting of these challenges has made it all too easy for investors to misdiagnose the investment environment as better than it is.

One of the very useful insights from the OECD reports is that technology is a necessary, but not sufficient, condition for productivity improvements. The diffusion of technological improvements throughout an economy is also crucial. In other words, for living standards to increase, we need both the "engine" of technology and a "transmission mechanism" in the form of diffusion. Unless and until that happens, improvements are unlikely to be universal and may promote even greater inequality.

Finally, the insight that diffusion is a key requirement for productivity growth is relevant to more than just financial assets. There is certainly a wide array of opportunities for entrepreneurial people and organizations to identify segments of the economy in which technology is not getting diffused efficiently - or at all - and to create businesses that enable diffusion. These could provide some lucrative business models and help the economy to boot.

RSS Feed

RSS Feed