Part of the answer may lie in a shift that occurred in capital markets during the year. For many years, the market for equity capital was characterized by massive quantities of share repurchases, many of which were funded with debt. The tide turned this year, however, as companies cranked up the issuance of new shares and dialed down repurchases. This change in net equity issuance has important implications for investors.

Capital raising records

An interesting and important part of the story of returns in capital markets for the year was the rapid reversal of sentiment in March. After monetary and fiscal policy initiatives were launched to stanch the crisis, investors flipped the switch from "fear" to "greed" in no time flat.

Shortly after that happened, another interesting phenomenon occurred. Companies began issuing new capital at a record-breaking pace. The Economist reports on the veritable feeding frenzy that ensued:

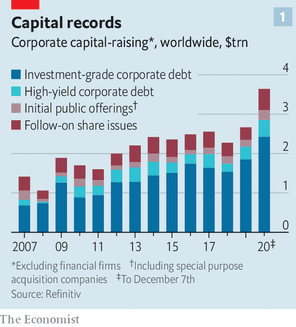

"According to Refinitiv, a data provider, this year the world’s non-financial firms have raised an eye-popping $3.6trn in capital from public investors (see chart 1). Issuance of both investment-grade and riskier junk bonds set records, of $2.4trn and $426bn, respectively. So did the $538bn in secondary stock sales by listed stalwarts, which leapt by 70% from last year, reversing a recent trend to buy back shares rather than issue new ones."

"Initial public offerings (ipos), too, are flirting with all-time highs, as startups hope to cash in on rich valuations lest stockmarkets lose their frothiness, and venture capitalists (vcs) patience with loss-making business models."

The cost of equity capital

The case for raising equity is a bit different though. For one, there is no backstop for stocks, at least not at this time. For another, there is no tangible, explicit number that investors can refer to as a cost of equity capital like there is an interest rate for the cost of debt.

Of course, there are various analytical formulas for determining the cost of equity capital, but most are backward looking and therefore provide only general approximations.

Because the cost of equity capital is imbued with greater ambiguity, any additional insight into this important metric can be useful. To this point, company actions reveal useful information content. When a company issues new stock, its management team is making a judgment that the cost of equity capital is attractive.

Two sides of a coin

Such a judgment also provides a strong signal for investors. The reason is that the cost of capital for a company is the same thing as the expected return for outside investors. It is just opposite sides of the same coin. If a company has a low cost of capital, it also has low expected returns.

Valuations are another way of looking at the same thing. A high valuation implies a low expected return which implies a low cost of capital. Some recent estimates of expected returns confirm that the equity cost of capital is currently attractive.

For example, GMO's latest forecast presents expected annual returns of -5.8% for large cap US stocks and -7.1% for small caps. Similarly, John Hussman's latest forecast calls for expected returns of -3.6% for the S&P 500.

The negative expected returns imply that the cost of equity capital is currently better than attractive for companies. It means investors are actually paying companies for the privilege of giving them capital. As such, it is no surprise that companies are taking them up on the offer by increasing the supply of equity capital.

Reality checks

If this conclusion seems stretched, it is corroborated by the reality check of basic supply and demand economics. All else equal, if you increase the supply relative to demand, the price goes down. As such, when the supply of capital goes up, its price comes down.

It is possible to argue that all else is not equal. After all, there are growth opportunities emerging from the disruption of the pandemic that arguably are best served by equity capital. While this is true in certain cases, it is much less compelling in aggregate. The bigger picture shows the economy is still operating at a lower level than when the pandemic struck.

Another piece of evidence for excessive supply of equity capital is the IPO market. While there is always some sense of opportunism with IPOs because they create liquid currency for founders, a new and different type of opportunism seems to be emerging this time around.

Byrne Hobart describes in his newsletter “The Diff” how Roblox and Affirm have delayed their IPOs because they "are both worried that the market is too good". Hobart's hypothesis is that the strategy is something like, "wait a while, figure out what else they can spend on, and then sell significantly more stock at a higher valuation than planned." In other words, they'll have to do some serious thinking about how to spend all of the money they can raise in such a benign environment. This is not an indicator that capital is scarce.

Card sharks or suckers?

The emergence of significant equity capital issuance facilitates an interesting perspective on the market. One line of thinking advocates for aggressive participation. It applies the poker analogy of "playing the player" and recognizes the Fed (and other central banks) are not going to let the markets fall for any length of time. As a result, dips are to be bought and leverage should be applied liberally. After all, how else can you earn returns?

Another line of thinking, however, recognizes this view as incomplete. Yes, the Fed (and other central banks) are players in the game, but corporate CFOs have also now joined the game. Further, those CFOs also happen to know their businesses better than anyone else and are privy to material nonpublic information.

This development radically changes the competitive dynamics. Before, aggressive investors were competing against less aggressive investors for return/risk opportunities. Such investors could fancy themselves cleaning up at the poker table at the expense of overly timid investors.

Now, aggressive investors are also competing against well-informed corporate CFOs. As these new players have entered the game, aggressive investors look more like unsuspecting suckers at the poker table.

Pandemic policy parallel

The continued runup in stocks amid substantial increases in new stock issuance has an interesting parallel to one of the pandemic related policy measures. Specifically, PPP loans were designed to assist small businesses in the US and “bounce back” loans served a similar purpose in the UK. In both, significant flaws have been found. The FT highlights problems in the UK:

"Launched by chancellor Rishi Sunak in May, it [the bounce back loan program] was designed to provide cash quickly for struggling businesses, but its loose rules were immediately exposed with some estimates suggesting as much as £26bn [of £43.5bn total] will be lost to defaults and fraud."

The Economist arrives at a similar conclusion, albeit in more modest terms:

"In a world of near-zero interest rates, it appears, investors will bankroll just about anyone with a shot at outliving covid-19. Some of that money will go up in smoke, with or without the corona-crisis."

To an important extent, investors can be forgiven for wondering how much longer the rally in stocks can continue. With low rates and ample liquidity there is little holding stock prices back. There is just no way to know when the rally will end.

What is less forgivable is overlooking how capital markets have changed through the course of the year. Namely, the increasing issuance of stock sends an important signal to investors. This suggests there is something of an upper limit to where stocks can go because companies will continue to issue new stock at extremely attractive rates until those rates become less attractive. Increasingly, benefits of the current environment will accrue to corporations at the expense of outside investors. Keeping this in mind will go a long way in preventing your own personal giant bonfire of money.

RSS Feed

RSS Feed