January 2016

Living in the midatlantic, most of the hiking trails we take are well-traveled and well-marked. Whether it is the ubiquitous white blazes of the Appalachian Trail or the neat signposts of Catoctin Mountain or Shenandoah National Park, the vast majority of the time we have excellent markings to guide our way.

Occasionally, however, we either explore less traveled (and less well-marked) trails or hike in areas like the Dolly Sods Wilderness which, as its name suggests, is not developed and is notorious for getting hikers lost. In order to successfully navigate these types of situations, a heightened sense of awareness is required as are some decent orienteering skills.

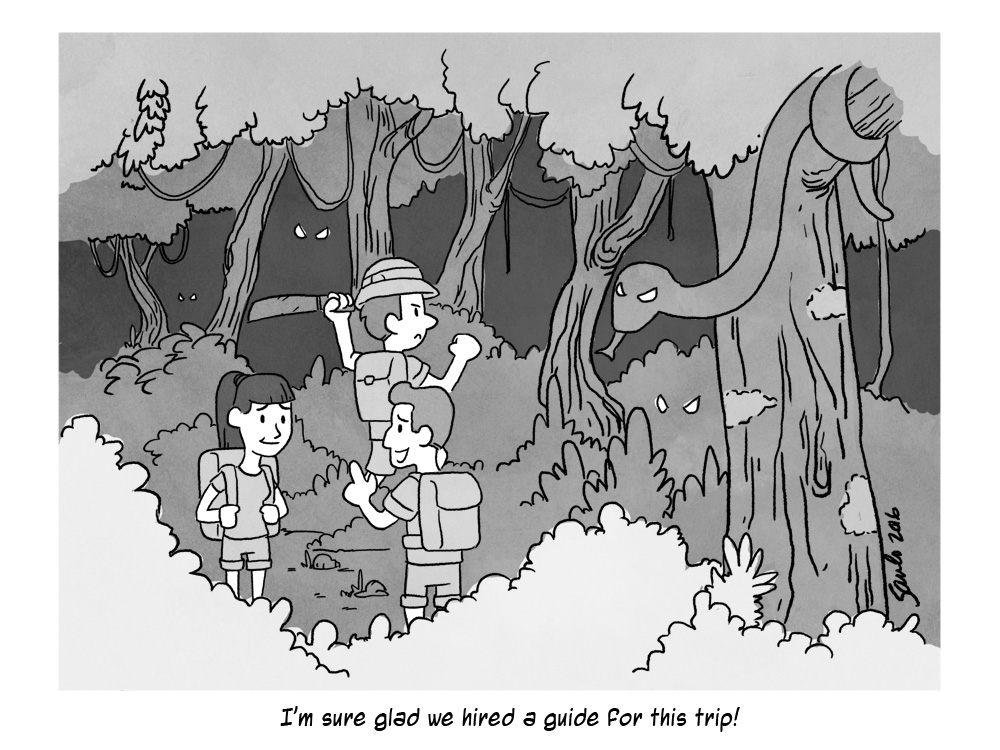

The current investment environment is quickly becoming more like hiking in the latter. For many years investors could follow the lead of strong economic growth. Even after the financial crisis in 2008/9 investors could follow the lead of the Fed’s interventionist monetary policies. After the Fed raised rates in December, though, there is no longer that simple beacon to follow. Much more problematically, several global forces are now converging in a way that is likely to meaningfully alter the entire investment landscape. For investors, this means it is going to take a lot more effort to stay on course.

In the meantime, most conventional signposts seem to be clearly showing the way: we don't have to worry too much about the market because the economic recovery in the US is well established and stronger than in other developed economies. This view is founded heavily on employment as a key indicator and the extremely low level of unemployment (at 5.0%) validates it. From this perspective, the Fed's raising of rates in December simply confirmed what was already clear from the data: the economic recovery is strengthening.

The conventional view is flawed is almost every respect, however. For one, it implicitly assumes that stock prices and economic growth are closely connected despite the Fed having severed that link years ago with unconventional monetary policy. Valuations matter and even more so in the absence of monetary support. Further, unemployment is only one indicator of economic activity and a lagging one at that. Measures that tend to be better leading indicators are actually turning down.

The challenge investors now face was framed nicely by Steven Major in a recent Financial Times article [here]. He asked, "Why does consensus thinking expect a conventional outcome from unconventional policy?" He responded by noting: "Almost by definition, history can be no guide to the future here."

If history can't serve as much of a guide, what can investors turn to for guidance? It is here that some orienteering skills in the form of critical thinking may help. In this case, it helps to take a few steps back, zoom our focus out, and look at the bigger picture. When we do that, we see the current situation as having evolved from the convergence of three powerful, secular, and unsustainable trends.

One of those trends is overconsumption. We live in a global society that generally values "more" as being "better" and this leads to exponential growth in the consumption of finite resources. These tendencies are exacerbated by public policy ideology that further encourages consumption by attributing slowdowns to "insufficient demand" and "correcting" course by increasing demand.

The notion that the supply of many resources we consume as a society are either constrained or finite is not controversial. Nor is the notion that as population and consumption per capita increases the upward sloping demand curve will eventually intersect the flattish supply curve. What is interesting is not so much the easy conclusion that we are rapidly running out of stuff, at least at the rate we want to consume it, but how widely disparaged this obvious observation has been in consumption-based societies.

So it’s not surprising that high and rising levels of debt comprises another unhealthy trend. For those who believe "more" is "better", they can often borrow to get it now rather than later. And feeding the tendencies toward consumption has been a nearly global policy bias towards debt exemplified by its favorable tax treatment. Further, public policy often promotes otherwise laudable goals such as home ownership and higher education by easing credit standards (i.e., by making debt more easily available).

China has been “exhibit A” for the trend in debt which George Magnus reported on in a Financial Times article aptly titled, "Credit binge is the real concern as crisis shows little sign of abating" [here]. He described that, "The growth in Chinese non-financial debt ... has risen from about 100 per cent to about 250 per cent of gross domestic product but, far from slowing down with the economy, the pace of debt accumulation has picked up in the past one to two years. Total social financing, a broad measure of monthly credit creation, is growing at nearly three times the rate of officially recorded money GDP growth, or more if you don't believe the official GDP data."

While debt can serve a useful purpose in funding fruitful enterprises or bridging a temporary gap, too often the use of debt becomes a habit that ends up borrowing from the future and/or misallocating funds that would be better spent elsewhere. This is exactly what has happened in China, the Eurozone, the US and nearly every major economy in the world. It’s like the old joke about unprofitable internet companies in the late 1990s that they could make it up in volume: it doesn’t work that way with debt either.

And this points to a third important trend which is that of increasing global imbalances. Whether it is China directing hugely disproportionate resources to investment in the form of construction and real estate development or Germany basing its economy on exporting goods to Eurozone partners, both situations create unsustainable consumption patterns. Further, these patterns have been exacerbated and perpetuated by increasing debt. Now, as these imbalances begin to correct themselves, the effects are being transmitted to the rest of the world via an ever more interconnected global economy.

It is through the lens of these three trends, then, that we can see the main economic stress points more clearly. The trends in overconsumption, high and growing levels of debt, and economic imbalances have been unsustainable and had to break at some time. While the condition of a structurally fragile economic and political environment is not new, we have talked about it several times over the last few years, two aspects are new. One is that these trends seem to be finally reaching their limits and another is the market's increasing awareness of this reality. These are combining to create a very different market landscape.

One very clear indication of change is that the major market indexes were essentially flat for 2015 after trending up powerfully since 2009. And make no mistake, flat is a very different trend than up!

Much of that ride up was facilitated by an environment of artificial stability that was induced by the Fed suppressing rates. These actions did not so much resolve underlying structural issues as to mask them and put them off until another day. In response, many investors simply took a position of following the Fed. Jared Dillian described the phenomenon beautifully in his recent piece on operant conditioning [here]: "We’re not altogether different from the pigeons in B.F. Skinner’s box. If you could make money by pushing a button, how many times would you push the button?"

When the Fed finally raised rates in December, two things changed, however. One is that the business model of simple directional bets funded with essentially free money stopped working. Another is that it introduced a great deal of uncertainty in the form of policy divergence: The Fed is now on a path to be raising rates at a time when most of the world's central banks are still easing. Dillian describes the conundrum for those "conditioned" investors: "Or: if you stopped making money by pushing the button, how long would you continue to sit there and push the button like an imbecile?" It's as if these investors were raised in the friendly confines of captivity and then suddenly dropped in the jungle and left to fend for themselves.

Another indication of change is that each of the trends in overconsumption, high and growing levels of debt, and economic imbalances create serious political challenges, both internally and externally. These points were encapsulated concretely in a recent investor letter from a hedge fund discussing why it was closing down [here]. The letter attracted a great deal of attention in large part because it was not forced to: the fund had a great track record.

Among the factors cited for undermining the attractiveness of the investment environment, the letter highlighted that, "data quality has deteriorated", "the transparency of decision making has also declined", and "fat tail risk has also increased". All of these issues can be seen as consequences of the increasingly contentious and political nature of the three economic trends. The implication is that political and geopolitical risks are becoming a fundamental aspect of investing.

For those with no experience or knowledge of investing outside of that last thirty years, this "new" landscape isn't actually new after all. George Friedman describes [here] that "the traditional concept was that economics and politics were intimately linked." In other words, "Geopolitics is economics. It is politics. It is military. These wildly diverse fields are really one ... All these are intimately related everywhere in the world."

Although the emergence of political and geopolitical risk as fundamental components of the investment landscape may appear to be a new phenomenon, with Friedman's context, we can see that this has been the norm historically and that the last thirty years was the anomaly. For those who can't adapt to the more complex reality Friedman warns: "If you look at the world through the prism of economics as an autonomous discipline, you are living in an abstract, unreal world."

A number of broad lessons emerge from this assessment. A key one is that investors have a new and much more difficult challenge ahead of them. The endeavor of investing is going to be very different and will require navigating a landscape that has fewer and less helpful signposts. The interplay of economics, politics and geopolitics will add further ambiguity to an already fragile and challenging environment.

How should we view immediate issues such China, or oil, or emerging markets? In each case it is important to remember that what is happening with each of these is the result of the fragile foundation of three unsustainable trends much more so than any daily incremental information. In short, this will likely be a messy, prolonged process of revealing misallocated capital and extinguishing bad debt.

While this suggests continued turmoil for "riskier" investments, it also portends caution for mainstream US stocks. Valuations of the major indexes are still extremely high and at the same time these global businesses are facing headwinds in nearly every market. It is hard to imagine investors will remain as sanguine about valuations amid steadily deteriorating fundamentals and eroding access to capital.

Another lesson from this analysis is that political sentiment is likely to play an increasing role in determining economic and public policy. In this respect, there are already many signs that the collective mindset of "more" is "better" is changing.

A recent article in the Financial Times [here] about the millennial generation in Japan provides some useful glimpses into how future sentiment may change. According to one 20-year old, "They [our parents] went a bit crazy. We are coldly practical". The generational difference is highlighted by another who notes, "The government wants us to believe in an economic growth situation that we have only ever read about in books." In general, "The generation turning 20 does not dream big but looks for small [moments of] happiness in their current situation. They don't save for something big, but as insurance."

We find these views fascinating for a number of reasons. One is that it is not hard to see that many of these values and beliefs are already established in millennials in this country and as such, they suggest a direction in which the social and political climate may evolve. Another is that they reflect views that are almost diametrically opposed to the "more" is "better" credo and therefore are likely to presage very different consumer behavior.

On this note, a final lesson that can be taken is that the landscape for investment services is likely to undergo at least as much change as that for investments themselves. Most conventional investment approaches are designed for conventional environments. Mutual fund investment strategy can be completely undermined by fund flows, passive strategies rely on reasonably efficient market pricing and good asset allocation, both of which may be challenged. Many exchange traded funds (ETFs) have significant liquidity mismatches in their structure. Further, new customers will be looking to prioritize saving and will only invest with solutions that are far more efficient and appropriately encompass (new) societal values.

In conclusion, 98% of visitors to national parks in the US only visit the main attractions and never set foot in the back country. This is pretty close to what happens with investment strategies too; the vast majority of people stick with very conventional approaches. As the investment landscape changes, though, investors will need to be prepared for more adventure than they have experienced in the past.

RSS Feed

RSS Feed