September 2015

One of the distinguishing features of long term investors is that they try to filter out short term noise in order to hear longer term signals. Such investors currently have a terrific opportunity to employ that skill as the noise surrounding the Fed's September meeting reaches a fever pitch. While many will be busy playing the parlor game of guessing whether the Fed will raise rates or not, a more useful exercise will be to focus not on the Fed's intent, but to consider its ability to help the economy along.

The ability of the Fed to improve the economy is the more interesting question for long term investors because it encompasses a far more comparable time horizon. While a central bank certainly can influence an economy over the short term by providing it with more money, it cannot actually create wealth. Worse, whatever benefits might be gained in the short term begin to give way to the negative consequences of continuing the policy of easy money for an extended period of time. In other words, the more the Fed is trying to help the economy with easy money, the more it is actually choking it off from sustained improvement.

As it turns out, it is pretty easy to understand the basic tools of monetary policy and therefore to frame the discussion. According to the theory, nominal GDP is a function of money supply and the velocity of that money, where velocity is the frequency at which money is used to buy goods and services. Technically, MV=PT, where M is the money supply, V is the velocity of that money, and PT is price times total output, or nominal GDP. A logical and obvious conclusion is that GDP is related to money supply and this connection goes a long way in explaining the Fed's agreeable view towards increasing money supply, despite its mandate to maintain stability in the value of the dollar.

There are, however, only certain conditions under which money supply directly affects GDP. George Gilder describes the dynamic in The 21st century case for gold: A new information theory of money: "For “M” to rule, however, in the equation MV=PT, money must have an inelastic element to multiply or push against. Velocity (or money turnover) must be reasonably stable and unaffected by changes in “M.” That is, people must spend their currency at a relatively even and predictable rate, regardless of the supply of money, and banks must loan money chiefly as it is made available by the central bank rather than as it is demanded by entrepreneurs with promising ideas."

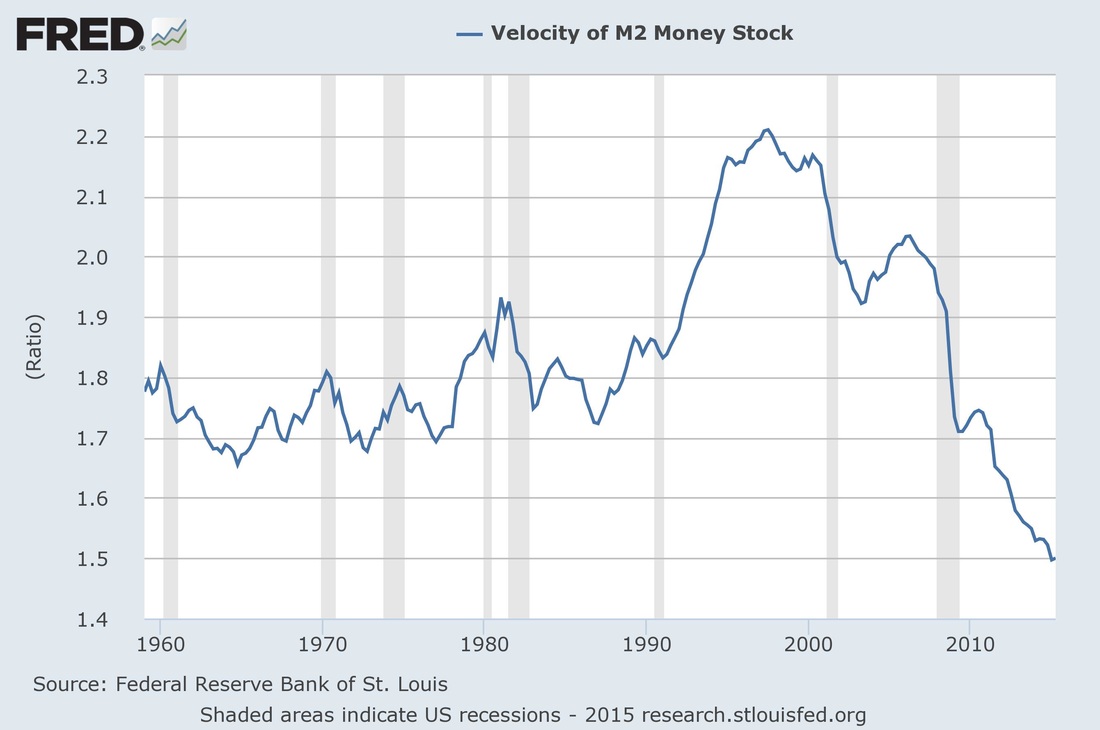

If these very specific conditions are not met, there is no direct relationship between money supply and economic output. Indeed, Gilder notes that, "We now know without a doubt from empirical evidence that velocity is not constant. Not even close." This can also be seen clearly in the chart below. Further, if these very specific conditions are not met, Gilder hypothesizes, "the people (including bankers) could counteract any given monetary policy merely by changing the rate they spent or invested the dollars. Why prevailing monetary theory disparages this possibility has long been an enigma to me."

And this is where things start to get interesting. So we have credible reasons to believe that the conditions which would validate the policy of money expansion are not met. We also have reasons to believe that "prevailing monetary theory" does not actively explore the ramifications of those conditions not being met. Finally, we can see that it is possible, at least theoretically, that forces outside of a central bank's control, i.e., people and bankers, can actually "counteract" monetary policy. Indeed this is part of the mystique of money velocity; it can serve to offset, or even undermine the ability of a central bank to nudge the economy by way of monetary policy.

Gilder's analysis reveals additional insight into the enigmatic nature of velocity: "Velocity is not an effect of psychological forces outside the economy. It is the active means by which economic agents— people—control money. Velocity is freedom. It expresses the public’s appraisal of economic opportunities and opportunity costs." In other words, it is an emergent property from an economy, and therefore one that cannot be controlled." Insofar as velocity represents the freedom of economic participants, it is clear how it is completely independent of, and quite potentially at odds with, policy goals for money supply.

Two people who have contributed enormously to the discussion of velocity are Van Hoisington and Lacy Hunt at Hoisington Asset Management. In their assessment [here], they explain that the productivity of debt is a key driver of velocity:

"Functionally, many things influence V. The factors that could theoretically influence V in at least some minimal fashion are too numerous to count. A key variable, however, appears to be the productivity of debt. Money and debt are created simultaneously. If the debt produces a sustaining income stream to repay principal and interest, then V will rise since GDP will rise by more than the initial borrowing. If the debt is unproductive or counterproductive, meaning that a sustaining income stream is absent, or worse the debt subtracts from future income, then V will fall. Debt utilized for the purpose of consumption or paying of interest, or debt that is defaulted on will be either unproductive or counterproductive, leading to a decline in V."

The idea that velocity is related to the productivity of debt and sustainable income was also picked up in a story by Charles Hugh-Smith in zerohedge, "Why QE won't create inflation quite as expected" [here]. The first point echoes Hoisington and Hunt's thesis, "The Fed can create money but if it doesn't end up as household income it is dead money." The piece continues, "If money were flowing into real-world households, we'd expect to see household incomes rise. Instead we see falling incomes." This gives us a very useful metric by which to judge the potential for sustainable economic improvement: household income.

The Hugh-Smith story also highlights an interesting dynamic with the money variable in situations that involve high levels of debt. He describes that, "money is destroyed, not just created, when assets fall in value and bad debt is written down." He continues, "To the degree that immense overhangs of bad debt are slowly being written off, money is being destroyed. If the Fed prints $500 billion a year, and write-downs erase $500 billion, the money supply hasn't expanded at all."

Indeed, this was the challenge in the immediate aftermath of the financial crisis. The story concludes, "Add all this up and here's what we get: money is not just being created by the Fed, it's being destroyed by declines in asset valuations and writedowns of impaired debt. Credit may be expanding but the top rung of households is paying down debt, not borrowing more, and the bottom 95% are unable to add much to their already staggering debt load."

While these theoretical arguments are compelling, it is even more compelling that they describe Japan's experience with easy monetary policy remarkably well. After the stock and real estate markets peaked in Japan in the late 1980s, bad loans littered its banking sector. Gillian Tett at the Financial Times reported on Japan's episode several times, but highlighted some of the consequences in "US can learn from Japan on policy for bad home loans". As she describes, neither bank leaders nor government authorities had any desire to acknowledge bad loans. "But while forbearance did avoid any sudden, dramatic plunge in prices, in its place it created a climate of deeply ingrained cynicism and unease."

In other words, as the bad loans lingered, confidence in the system eroded considerably. She continues, "There was a gnawing suspicion that prices might fall in the future if (or when) more bad news emerged. The consequence was a mood of corrosive distrust and unease, which was hard to articulate or measure but which fostered a deflationary mindset."

The Japanese experience provides, or at least should provide, some valuable lessons regarding the limited ability of monetary policy to effect economic improvement. For one, in situations involving high levels of debt (which includes most of the world right now), adding to the supply of money only addresses the proximate problem of declines in money (through the writedowns of bad debt). It doesn't sustainably increase demand or consumption.

Nor does monetary policy address the issue of velocity, which itself is a derivative of (i.e., response and adaptation to) a fraught economic environment. This is an important point; monetary policy is itself an element of the economic environment. As such, it constitutes an intervention that can distort market mechanisms and create uncertainty. It may create uncertainty in regards to any number of factors including bad loans, interest rates, regulatory issues, and the duration and/or magnitude of policy affecting any of these items.

A unique feature of monetary policy is that its character fundamentally changes as the duration and magnitude of the policy are increased beyond certain thresholds because beyond those thresholds, a feedback loop is created. Modest policy changes for short periods of time can be accepted as transient by economic participants with the full expectation of an imminent return to normalcy. Strongly interventionist policy extended for several years, however, eventually creates a sense of capriciousness and uncertainty that causes economic participants to adapt by throttling back on activity. It's like walking a dog on a leash; short, timely tugs on the leash can help keep the dog in line but a long sustained pull on the leash can strangle the dog.

Unfortunately, we can see all too clearly that the real economy is beginning to choke under the Fed's sustained pull on the monetary policy leash. Certainly this sustained period of unusually low rates has incentivized speculation and capital misallocation which in turn lower productivity which in turn lower economic growth. As Gilder notes, "With a near zero interest rate policy, the Fed falsely zeroes out the cost of time. This deception retards economic growth."

How can all of this help long term investors? For one, it can help investors to avoid getting sucked into the interminable chatter about what the Fed is going to do. For long term investors it doesn't matter. While the Fed can influence paper asset prices for periods of time (which may be of interest to traders and speculators), it has virtually no ability to sustainably improve economic growth.

The variables that do provide the cornerstone of sustainable economic growth, and therefore the foundation of long term asset values, revolve around income and investment. One of the best analyses of this comes from John Hussman in his commentary, "Eating our seed corn: The causes of economic stagnation and the way forward" [here]. He notes, "What raises both real wages and employment simultaneously is economic policy that focuses on productive investment – both public and private" He also clearly juxtaposes economic (fiscal) policies and monetary policies: "What our nation needs most is to adopt fiscal policies that direct our seed corn to productive soil, and to reject increasingly arbitrary monetary policies that encourage the nation to focus on what is paper instead of what is real."

Finally, and following the same line of thinking, it will be useful for long term investors to monitor and adapt to the policy environment. To be fair, this does include keeping an eye on the Fed's September meeting as one data point that can incrementally inform the trajectory of future policy direction. More importantly though, long term investors should keep an eye out for signs of the Fed retreating from its activist policy stance and for any signs of fiscal policy initiatives that encourage productive investment.

RSS Feed

RSS Feed